Vorresti scrivere anche tu un Articolo o un Post molto attrattivo in Rete? Non sai come? Non hai tempo? Chiedi al RoboWriter Web Writer di scriverlo sulla base di una serie di domande che ti porrà. Prova gratuitamente Web Writer! [Nota della Redazione di ComplexLab]

Dear Friends of Umanot.com who already follow, or want to start following, its growth which has reached the equivalent of a fifth year high school student, and while waiting to face the "maturity exam", I would like to inform you of its current and decisive Turning Point with plausible next "Quantum Leap" within 6 months.

SITUATION :

1) Umanot - Cognitive RoboTrader based on Physical Analysis (R) - is ready for its further and decisive leap in quality ("Maturity exam") for effective online trading on the basis:

- of the notable operational results since November 2019 (see, in http://www.umanot.com/it/performance , the box at the top left with the operations on the Ftse-Mib Index that many of you have received via WA);

- of a significant improvement in the writing methodology and, above all, in debugging the complex Umanot code, decisive for my personal leap in processing-creative quality (Umanot "trained" me - even... reprogrammed me!);

- of new tools and metrics for the analysis and evaluation of Umanot's behaviour, logic, results and, above all, expectations (such as the Trades Histogram - a sort of "encephalogram" - and, above all, the Expectation Index for give a scientific measure to the most important, and overlooked, questions of an Investor, namely: by investing with a trading system, what ethically and scientifically reasonable expectation of return do I have for the next 12 months?

- of some important insights (including the “Fractal-Wait” already verified but to be implemented) effective for creating some decisive functions in gestation since the beginning of 2020 and effective for "bringing it to the University", namely:

a) a superior understanding of the Trends (with their complex fractal nature) at levels 1, 2, 3...;

b) the exploitation of a "Viagra effect" :-) that emerged from the Protective Trades, created to reduce, as they have done very well, the drawdown in order to guarantee very monotonous Total Profit / Equity curves. These Protective Trades, which overcome the obsolete concept of Stoploss, are "wrong" in a third of cases but... they turn out to be even more useful as effective "Peak Inversion Detectors" of relevant moments of change in the trend of the Stock / Market.

2) On the basis of these results which promise interesting further developments, a business model has been developed that could be implemented in a short time, with the tools and infrastructures present and with small investments and interventions.

3) Currently, Umanot needs further means and funding to first pass its "Maturity exam" and, subsequently, to face "University".

GOALS

(within 6 months of the start of a possible UMANOT-Funding described below - approximately by the end of 2021 )

Here I share the Objectives in which I firmly believe and which, as anticipated, require fresh resources [the data refers to Umanot's operations on the 40 Ftse-Mib securities from 1 Jan 13 to 30 Apr 21 ]:

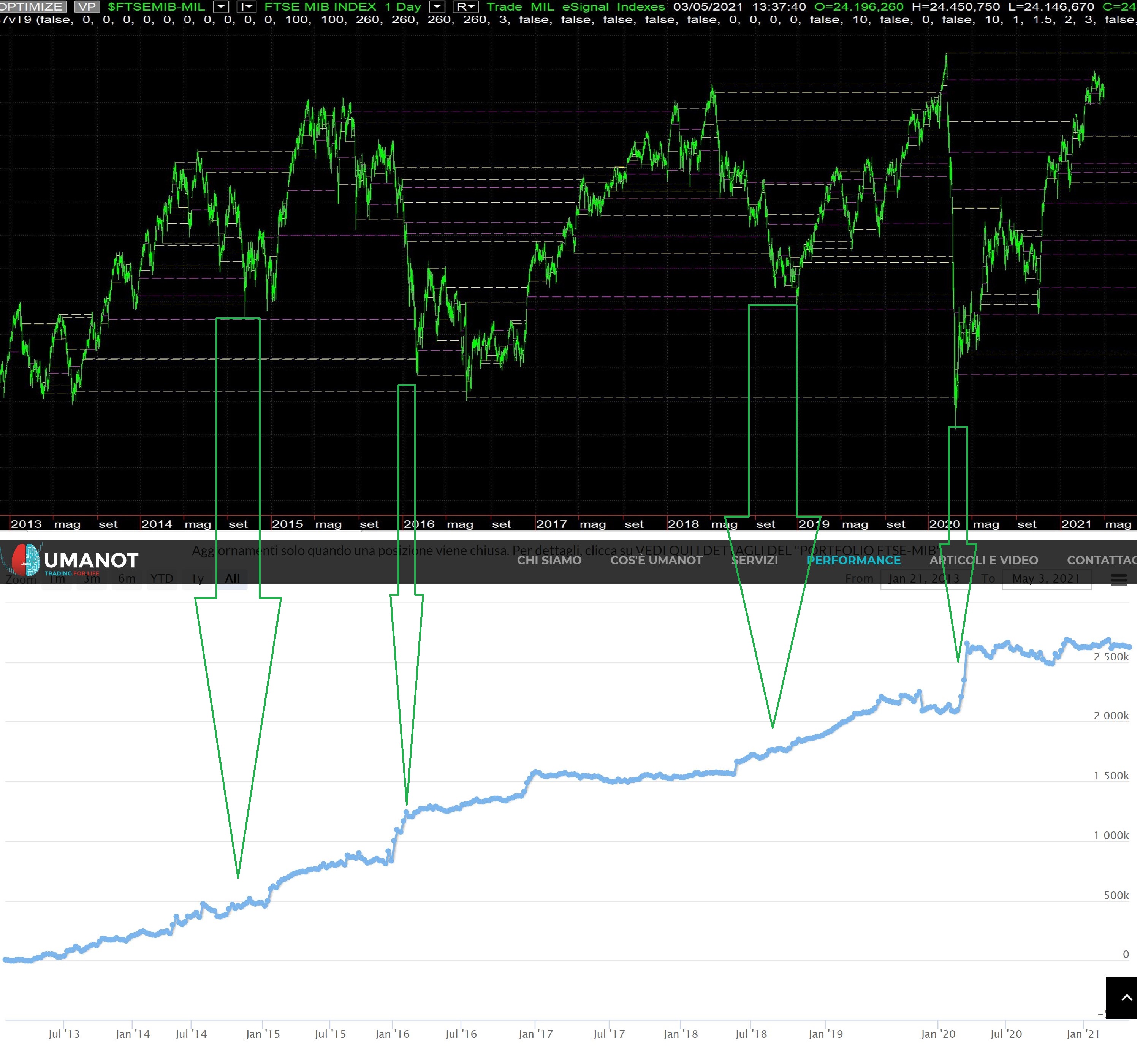

1) the next improvements are based on the current distribution between excellent titles (25%), decent titles (55%) and poor titles (20%) characterized by an interesting double asymmetry : there are many titles that earn (31 out of 40) and earn a lot (over €300k/each on STM, MB, LDO...) while those who lose are few (9 out of 40) and lose little (always less than -20k€ except for two cases at -40k€ associated with securities "particulars" such as RACE and JUVE).

The Profit Factor is currently 2.9.

2) it is therefore absolutely realistic to increase the Total Profit of the Portfolio of the 40 FM Securities by 50%, currently equal to approximately €2600k and obtained with an average investment of €520k and with an average annual return ( Rma , very regular, as from curves visible on the site) equal to 21% --> Objective: 30%.

3) furthermore, a further result will be to further reduce the DrawDown of the FM40 Portfolio, moving from the current values (21% maximum peak in the childhood period 2013, and only 5% average value over 8 years) to the following Objectives: respectively, 15% and 3%.

4) the result of this will be a decisive improvement in the Expectation Index (created in the summer of 2020), which measures how much past performance is a reliable reference for expected performance over at least the next 12 months. Given the Rma, which will have to go from 21 to 30%, and with the reduction of the anticipated DD , the EI will have to go from 1540 to at least 1900 with the 10% range used today. NB : its theoretical maximum is, as of today, equal to 2150 (= 8.3 years * 260 days), i.e. equal to the number of days recording an Rma within a 10% range around its 260 day moving average. This gives a significant scientific-ethical expectation of performance over the next 12 months (at least).

5) Finally , the result of the results must be to improve the current timing of the reports on the FM Index from the current range 1-90 days before / 0-10% DD max to: 1-45 days before / 0-5% DD max ( NB : the case of 1 day notice and 0% DD is real, as happened on November 2, 2020).

At least grant me one graph in this document, with availability to produce others on request: Umanot loves Black Swans and will want to "cook" them even better in the future starting from the 4 which, since 2013, it has well harvested with more or less excellent profits as indicated by the arrows between the two related graphs that follow (Official FM40 Index from 1 January 2013 to 4 May 21 compared to the Total Profit of the FM40 Portfolio managed by Umanot).

A sort of anti-heart attack "insurance policy" ....

UMANOT-FUNDING: Return and Contribution

For such very realistic goals, the complexity of Umanot's code requires considerable care and focus.

I am therefore launching here a "patronage" proposal limited to 6 months which includes a:

1) Return for those who participate in terms of:

a) Umanot-based consultancy support with my comments and graphs ;

b) life-time license of a Read-Only version of Umanot at the beginning and one at the end of this 6-month "take-off" period of the Project;

c) sharing of opportunities, in pre-emption, of establishing possible next companies and/or investment funds.

2) Contribution which, cumulatively with other interested parties, allows me an endowment of €50,000 through the following options [individual contributions to be paid in two tranches : 50% at the beginning and 50% halfway through the project, after three months. Values without VAT]:

- €4,000, immediately obtaining Umanot-based consultancy from me (alerts via Whatsapp and/or email + sharing of my comments and graphs) for at least 1 year;

- €10,000, obtaining a life-time license (Read-Only, protected) at the beginning of the period and a new version at the end of 6 months of development;

- €20,000, obtaining a six-monthly update of the further more advanced versions of Umanot for a maximum of two years (4 versions), at a fixed price (based on the current valuation of Umanot).

NB: each item is independent and cumulative

A monthly recurring contribution is available in the form of an "All-inclusive package" :

- €1,000 / month, obtaining a 12-month license (Read-Only, protected with expiry) with any immediate significant updates, assistance with the installation of MultiCharts & Umanot, both consultancy-operational and technical support (guarantee of corrective intervention as detailed below) .

IMPORTANT :

- Umanot is written in PowerLanguage and runs on the MultiCharts platform. Any advice, support and assistance on this platform can be defined based on real individual needs, such as (by way of example to be defined on a case-by-case basis):

- right to call and consultancy on the functionality of Umanot and the MultiCharts platform (SLA: response within 4 hours / consultancy, indications within 2 working days): €600/year;

- guarantee of decisive intervention on the functionality of Umanot and the MultiCharts platform (SLA: response within 4 hours / resolution of the problem, unless delays by MultiCharts, within 5 working days): €1,200/year;

- installation and start-up of MultiCharts & Umanot: €500 one-off (purchase and download of the MulriCharts license by the Customer).

- A Confidentiality Agreement will be shared before starting participation in the Umanot Project as per the terms described above.

For healthy online trading , also capable of catching yet another " black swan" (which Umanot loves!).

For questions and clarifications: nicola.antonucci@umanot.com

Meanwhile...

Ap-paying Days!

via del Caravaggio 5

20144 Milan

+39 348 8558073

nicola.antonucci@umanot.com

skype: nicolaantonucci

Il primo manuale di ANALISI FISICA per Traders Scientifici per cavalcare la caotica imprevedibilità della Finanza

Il primo manuale di ANALISI FISICA per Traders Scientifici per cavalcare la caotica imprevedibilità della Finanza