Facility management e finanza immobiliare

[To better understand how to exploit Opportunities from a modern and complex Facility&Property Management, with today Clients, Suppliers or Investors and by attracting via Web new ones consistent with your own Values, contacts us: redazione@complexlab.it ]

Index

1. Introduction

4. References

1. Introduction

Quantifying unsold stock in Italy is a subject that is attracting the attention of various players in the construction and real estate sector, such as public bodies involved in planning projects, promoters and developers, who are now facing a crisis after a decade in which the construction industry recorded steady growth rates. The economic and social consequences of the crisis have a significant impact, in part due to the size of the market. In Italy, real estate (investment in construction, the cost of renting and services of intermediaries) accounts for nearly one fifth of GDP, and over 60 per cent of household wealth, with a value around four times higher than disposable income, compared to 2.5 and 3.1 times higher in France and in Germany. In Italy the particular significance of real estate wealth is that it is linked to a high percentage of home owners (73.7 per cent in 2007, around 16 percentage points higher than the eurozone average). Credit linked to real estate (family mortgages, loans to developers and property-related services) accounts for one third of total bank loans (Bank of Italy, 2009).

Despite the importance of this market in terms of size and impact on the credit system and social dynamics, it still lacks transparency.

The aim of this article is to identify the limitations and critical issues in the way information in the real estate sector in Italy is currently managed, and propose the principles of a method that would provide information and comparison of the phenomenon of over-supply and non-rational land use.

This study is based on a series of assumptions, the first of which is a definition of “unsold”, deemed to mean “the amount of new housing units neither occupied nor sold nor rented”. In effect, unsold stock can be considered as over-supply of construction.

While it may be true that “construction is the driver of economic growth”, the article attempts to evidence the limitations caused by the scarcity and lack of transparency of information, without which it is impossible to engage in any planning activity. A further aim is to show that without planning informed by the right data it is impossible to generate real and lasting development (Camagni R., 2012). This phenomenon in the residential sector is under-researched and has enormous social consequences; it is closely linked to issues of transparency and equity in the market, to consumption (or non-rational use) of the land, to real estate financing, and to the effects of planning on the land (Pileri P., 2011).

In reality, two distinct real estate markets can be identified in Italy: a market of direct users (families that buy a home) and a market consisting of institutional investors, who decide on their investments based on criteria of cost and benefit, usually in areas like offices and commerce.

The investment market has developed effective systems to analyse and understand the market, and many consultants provide periodic surveys of the cities where production is more dynamic and of greater interest to investors. This data (prime yield, prime rent, office and retail stock, take up and vacancy, etc.) is available and well known to operators, though it is limited to Milan and Rome.

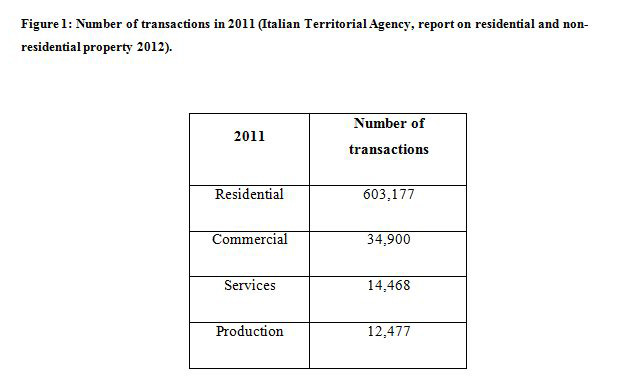

As regards the direct user market, namely families and individuals, there has never been any need to have transparent and clear information available (number of transactions, absorption rate, available stock, etc.) so the residential sector, which is the largest in terms of transactions (Figure 1: Italian Territorial Agency, number of transactions in Italy in 2011), is represented in a much less clearly defined manner.

2. Findings and Methods

2.1 Analysis of the research and available data

At first sight, quantifying unsold stock appears relatively straightforward, in the form of information that can be retrieved from data already available in a number of databases (National Institute of Statistics – ISTAT, research institutes, chambers of commerce, industry-level associations) or by using data gathered indirectly from utility companies (telephony and energy).

However, the real estate market is rather complex and the data available often of poor quality, which can lead to misinterpretation and unreliable conclusions. “The economic analysis of the real estate market is affected by the limited availability of timely information on the main indicators of the sector. In Italy, this is largely due to the variety of the data retrieved from various sources, which sometimes causes interpretation problems when evaluating both price and production trends, while statistical progress achieved in recent years has not bridged the data gap with the English-speaking economies” (Bank of Italy, “The Performance of the Italian Housing Market and its Effects on the Financial System”, 2009).

Little has been written in Italy on this subject, and until the crisis broke with its devastating consequences no operators had thought to research the absorption rate of the new residential housing market.

Until 2007-2008 demand was able to absorb the entire stock of new housing, often as early as the initial stages of the process, with purchases “off plan”. The traditional construction process started from the realistic prospect of selling to a wide, non-specific and undifferentiated market (Frontera M., 2012).

Before considering the critical aspects resulting from a lack of reliable data it is advisable to list all the available information and indicators used by the market to find out about available stock and/or unsold stock, with particular reference to data that will provide time analyses and trend verification.

The data and information that help to determine unsold stock available in the Italian market can be divided into three categories:

- Generic market analysis: research that aims to explain other phenomena in the real estate market in general terms and that only marginally covers the phenomenon of unsold stock;

- Demographic-based research that aims to explain unsold stock and the need for housing based on demographic flows (in and out);

- Specific research into unsold stock carried out by institutional bodies (universities) or research bodies.

Generic market analysis

The research institute Scenari Immobiliari conducts periodic research on the real estate market. This institute carried out a study for the weekly publication “Edilizia e Territorio” (May 2012) that estimated the number of new housing units for sale (new unsold housing, as it is referred to in the study) using an unknown quantification method, but one which was largely based on data reported directly from the field, such as building sites open or recently closed. The survey focused on certain qualitative elements, such as small lots on the outskirts of large cities, not including the market; the lack of urbanization of areas with unsold stock that adds to the crisis; the variability of the absorption rate compared to the qualitative level of construction.

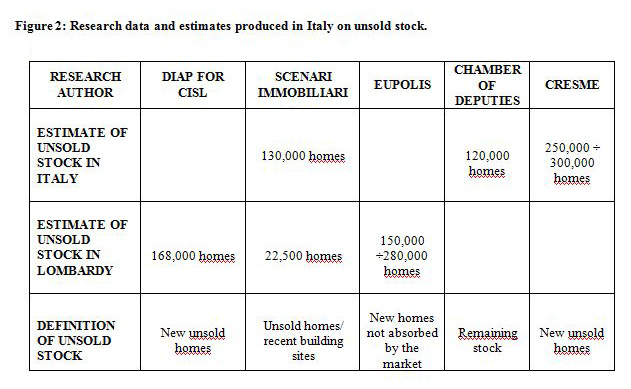

The study identified 130,000 unsold homes in Italy and 22,500 in the Lombardy region.

Demographic-based research

The most complete research available includes studies by the Department of Architecture and Planning (DIAP) at the Politecnico di Milano carried out for the CISL trade union: “How much housing for how much demand ” (2011) and “Housing supply and need in Lombardy 2012” (2012) (DIAP Politecnico di Milano, 2011). The aim of the research was to study the over-supply of developments in the private market. The argument put forward by the DIAP research was that private residential development has not been absorbed by the market, while the production of social housing at low rents intended for a specific social class appears to meet a very strong demand for housing. The analysis method used was based on demographic data that calculated the volume of stock remaining on the market as the difference between production and potential demand in relation to migratory flows. It is important to note that the research did not distinguish between recently built unsold housing and available housing stock unoccupied for some time. Moreover, this data was obtained by difference, considering building production and estimates of demand and need. In reality, it is clear that the dynamic of migratory flows, the creation of new households and other external factors - such as the economic crisis - have a serious impact on demand and cannot be considered factors with constant values over time (for example, in 2012 the OECD noted a fall in migratory flows entering Italy for the third consecutive year). This research identified 168,374 unsold units in the Lombardy region alone. There was no figure given at national level.

Research by institutional bodies

Eupolis Lombardia (Institute for Research, Statistics and Training of the Lombardy Region) highlights the absence of specific data reporting for the calculation of unsold stock in Italy and the Lombardy region, and believes that it is necessary to proceed using specific estimates (Eupolis, 2011).

First and foremost, this is achieved by defining unsold stock as “the percentage of housing that the real estate market has produced and which has not met sufficient demand”, considering this only as a percentage of unoccupied homes, and stressing that “unsold” means “housing that has never been purchased following completion and which remains the property of whoever built it”. This definition enables the phenomenon of unsold stock to be approached more effectively, resulting in a distinction between older unoccupied housing and new housing not absorbed by the market.

The calculation proposed by Eupolis is based on the difference between the volume of supply of new housing in Lombardy produced in 2011 (ANCE-Cresme, 2011) and the potential demand for housing observed between 2001-2009. Of course, as this is a method that provides an estimate, a number of scenarios are generated, the variability of which depends on the different impact of the creation of “new households”, or on external factors such as access to credit or the slowing down of production owing to the economic crisis affecting firms.

These scenarios identify the number of unsold homes in the Lombardy region alone as between 150,000 and 280,000. There was no figure given at national level.

The Seventh Commission of the Italian Chamber of Deputies produced a comprehensive study of the situation of the real estate market (Camera dei Deputati, 2010), which indicated unsold stock as a figure seemingly out of step with other studies. The report, produced by the Environment Commission for the Chamber of Deputies in July 2009, described unsold stock as “remaining stock”, without specifying whether it regarded recently built housing or not, and giving a figure of 120,000 unsold apartments (see p.170 of the report). The report of the Seventh Commission used a database that drew on periodic research work edited by the CRESME Research Centre (Centro Ricerche Economiche Sociali di Mercato per l'Edilizia e il Territorio), while CRESME’s Economic Observatory, in collaboration with ANCE (the Italian Contractors’ Association), produced an estimate for Italy at the end of 2011 of between 250,000 and 300,000 new unsold homes, compared to 40,000 in 2008.

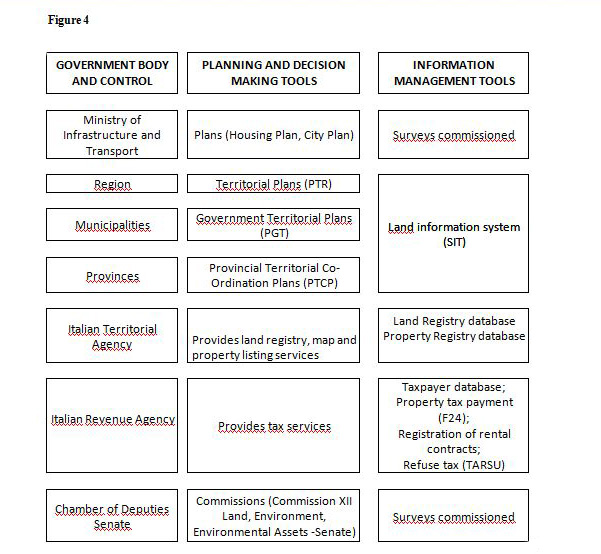

It is evident from the figures reported in Figure 2 that all the research available in Italy on the subject of unsold stock uses a variety of databases, which identify unsold stock differently and arrive at conclusions about it that differ significantly. Basically, it is apparent that the system is not able to quantify how many new homes built have not been absorbed by the market. In the absence of a link between the databases of State agencies and bodies (Italian Territorial Agency), local government (Regions and Municipalities) and private bodies (research institutes and industry-level associations), only demographic forecasts are available, capable of quantifying potential demand, surveys on samples (for example, limited to specific areas) or other estimates in order to determine unsold stock. The results are unreliable and contradictory.

This uncertainty causes serious critical issues both for public bodies and private market players. There is clear evidence from public bodies of an urgent need to find a method that can estimate how much unsold stock exists and which can support decisions relating to land planning, building projects and management of housing stock. For their part, private players in the market highlight the fact that correctly determining the volume of unsold stock could help to produce buildings more suited to the market.

Some international experiences

Switzerland: Buildings and Dwellings Statistic (BDS)

With a view to making data more useful, an important aspect of data management on production is the ability to report information in short horizons, so as to identify any signs of change in the markets and/or in the purchasing inclinations of families. Reporting and analysing data on an ongoing basis reveals a picture of what has taken place, but without being able to make any updates swiftly.

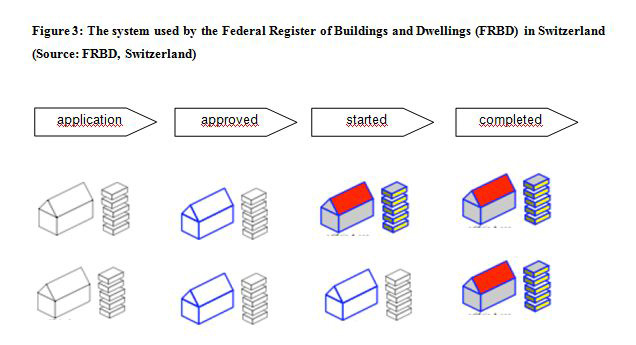

This is one of the strong points of the BDS (Gebhard, F., 2007)), the system in use in Switzerland. It is an instrument provided by public bodies that enables the State to evaluate the general situation of the real estate market, linking construction to the rate of absorption. The BDS has replaced the survey on buildings and housing that used to be carried out every 10 years as part of the Federal Population Census (FPC).

The system was developed gradually in three phases. 2009 saw the start of the data reporting process called “Mini BDS”, comprising the analysis of data on buildings and housing supplied by the Federal Register of Buildings and Dwellings (Fed. RDB). The intermediate phase “Midi BDS” was implemented in 2010-2011, and combines data from the Mini BDS with data from the Population Registers (PR) linked to the Federal Building Identifier (EGID) and structural data from the Population Census. The third phase (Maxi BDS) completed in 2012, is a link with the EWID/EGID (Federal Building/Dwelling Identifier), which enables more in-depth information to be obtained, by identifying the data reported by smaller administrative units through a link with the land registry database.

The Federal Register of Buildings and Dwellings (FRBD) was set up through co-ordination with the Municipalities and Cantons in an effort to report and organize periodic data with short horizons with the aim of providing responses swiftly to those involved in planning, projects and analysis of territorial dynamics. Construction activity is recorded on an ongoing basis and since 2010 data has been reported four times a year. Each Municipality updates its construction records using a customized software application, which is useful both for planning at local level and for wider statistical use. This system makes it possible to check the rate of progress of projects, mapping basic dates for each project:

- date of planning application;

- date when planning consent granted;

- date work started;

- expected duration of work;

- date of completion.

The system specifies intended use (residential/non residential) for all new build completed, recording this at the project stage. In the case of modified or demolished property the system does not record a new project but updates the FRBD with the modifications carried out. However, in the case of housing the granting of planning permission triggers an entry in the FRBD by category. This system can bypass the time limitations caused by censuses carried out every ten years, and improve the quality of information by implementing a system with horizons that enable decisions to be made swiftly. The uncertainty deriving from the lack of up-to-date information is reduced, while the transparency and usefulness of the direct data is increased. The system can provide a useful tool for construction projects and spatial planning, serving both the institutions, construction firms and, last but not least, research.

From analysing this case one fundamental aspect in particular emerges: data reporting on a statistical basis can be done just in real time, so that the benefits of recording data when projects are approved can be recorded, resulting in:

- greater control over projects

- more transparency in the market

- easy access to data for verifications

- greater scrutiny of the phenomena by public bodies, universities and investors to improve the processes, leading to a market that is easy to study and undoubtedly more efficient

- greater streamlining of bureaucracy without giving up regulation.

SPAIN: how the Spanish quantify unsold stock

Spain has experienced a period of intense real estate development, which has often been disorderly and fuelled by the easy access to mortgages provided by lenders on the back of strong inward investment from abroad (particularly in the south) in all fields (Camagni 2012).

During this growth period the market gradually absorbed most of the supply, the majority of which was located in the coastal areas, also due to the booming tourist industry.

In June 2011 a study by CatalunyaCaixa (Catalunya Caixa, 2011) was published, in collaboration with the Department of Applied Economics of the Universitat Autònoma de Barcelona (UAB).

The study by CatalunyaCaixa focused on the state of the real estate market examined by area, given the great diversity at local level in the Spanish market, which derives from an administrative system that lives and breathes autonomy.

The study entitled “La absorción del stock de vivienda nueva pendiente de venta: situación y perspectivas” (Absorption of new unsold housing stock: the situation and forecasts) focuses on a fundamental aspect: the re-absorption of stock, which is seen as essential to reviving building and employment in the residential housing market.

This type of orientation, which is very similar to the objectives of researchers at the Department of Architecture and Planning at the Politecnico di Milano for the Italian context is, however, conducted quite differently.

The research is carried out by region, province and municipalities with over 10,000 inhabitants.

Analysis of demand is addressed using a demographic study based on trends in previous years, even forecasting less intense demographic flows and dividing the factors that influence the market into two categories – factors that hinder demand and factors that stimulate demand.

Factors that contract demand are:

- Fall in immigration;

- Ageing baby boomers.

Factors that expand demand:

- Rise in life expectancy.

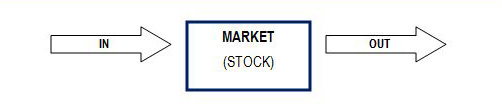

The model proposed to estimate the absorption of stock looks very like a “black box”

IN = housing completed

OUT = property sales and/or owner-built homes

Knowing how many building sites are open (and the respective dimensions of construction) up to the first quarter of 2011 (the study ended in July 2011) provides fairly reliable data on the number of building sites that will be closed with housing ready for delivery in the short term.

The model used therefore looks like this:

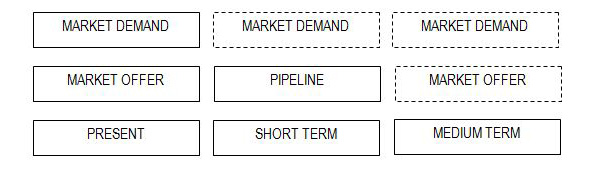

It is evident that demand is subject to variations caused by the uncertainty of the time horizon in the short and medium term. Demand is also influenced by the impact of demography (the only means to predict what will happen in the medium-to-long term, even though this becomes less and less reliable as the time horizon increases).

The situation in Spain is evaluated using the following parameters:

- Evolution of supply over the year (in this case the year preceding 2010);

- Demand for new housing in 2010;

- Stock of new homes on the market (data for 2010 is aggregated with data from the fourth quarter of 2009, updating the volume by adding this figure to completed new build);

- Supply in 2011-2012.

For each of these items an analysis is made taking into account the parameters that can affect factors (change in tax regulations, immigration, collapse of mortgage availability, demography, new build etc…).

The study highlights a particular phenomenon called autopromoción, which refers to a property built by the owner on his land (in Spain this accounts for a steady 18% of house sales). The study considers autopromoción as a solution that does not produce unsold stock, and which has all the potential to create problems for the control of land use. Clearly, this solution has a considerable impact on land use, as it causes problems for territorial planning and generates growing management costs (e.g. services) for local administrations.

However, the study does shows that building to order or at least based on the near certitude of absorption, is one way to avoid generating unsold property.

New Zealand: a regulated market

New Zealand is a case study with particular features, which seem remote from those in continental Europe. It is a country that is not densely populated and which is culturally and geographically remote, sheltered from the global crisis that has hit Europe and the US.

In reality, the country as a system shows many similarities with English-speaking countries, also due to shared cultural and language roots.

It shows that the problem of unsold stock can be approached differently, by highlighting the different parameters used, the range of analytical models, the specific features of the market and the solutions found to tackle the problem.

This is a relatively small and controllable market, transparent as regards the administrative culture and with relatively young institutions. Simple reports are produced, packed with data, without too many qualitative analyses, while avoiding long-term forecasts that are usually not very reliable.

The specific features of the New Zealand market can be summed up as follows:

- The market is regulated by a central institution that brings together the various players in the market;

- Registered and authorized agents account for 95% of transactions mediated by professionals;

- Supply is lower than demand;

- The “unsold timeframe” is limited (the indicator representing the period of time a home is on the market awaiting a buyer);

- The amount of unsold property is very low;

- The market is not particularly affected by changes in price.

The website Realestate.co.nz, used as the basis for the research, is the official portal for the real estate sector in New Zealand.

The shareholders in this initiative are REINZ (Real Estate Institute of New Zealand, the industry-level association for real estate agents) at 50% and the six largest real estate firms in the country (also at 50%).

The website provides details of 110,000 properties for sale, including:

- Sales and rentals

- Commercial sales and leases

- Rural and farm properties

- Business brokerage/transfers.

Data is reported by more than 1,000 offices, covering 95% of all properties entering the market input by the country’s authorized agents.

Visitor statistics are 400,000 visits per month to the website by national and international users and 100,000 individuals per month from 200 countries.

There are 3 parameters used to evaluate New Zealand’s real estate market:

- Asking Price: (by month), is calculated as the truncated mean at a certain value, in this case at 10% (the truncated mean is limited to a specific number of values in percentage terms; this strategy is used to eliminate the highest and lowest spikes in value so as to obtain values closest to the mean. For example, in a truncated mean at 50% the lowest 25% and the highest 25% values are discarded). The values are corrected by seasonal adjusted data (3MM, 3 Months Moving)

- New Listings: values of new homes entering the market, where the data is seasonally adjusted (3MM)

- Inventory: for weeks where a property remains unsold on the market, the value is compared with a straight line on the graph corresponding to a “long term average” of the time values equal to 5 years of time series using seasonal adjusted data.

Seasonal adjusted data is produced using the X12 Arima method, i.e. software developed by the United States Census Bureau to remove seasonal data from time series. This work was carried out by NZIER.

The three parameters described above are analysed by region, dividing the country into 19 areas (or regions).The same parameters are used for the large cities (Auckland, Waikato; Canterbury and Wellington).

The market data is enriched with market sentiment rating with the aim of representing the various areas of the country by neutral values (equilibrium between supply and demand), or where there is an advantage for buyers or sellers. This elaboration is made possible by evaluating the basic parameters produced by the network of agents who contribute the data.

The data is reported and analysed at each month end and the report is compiled by the first day of the following month. This system gives an immediate response on the state of the market and enables forecasts with a horizon of between two and four months to be made.

It also enables the issuing of new planning consents to be regulated, also in terms of market trends, demand and actual absorption capacity.

Considerations on the experiences analysed

These cases studies make it possible to compare data reporting and management models rather than illustrate the factors that characterize the local real estate markets.

This “benchmarking” has focused on themes relating to ownership of data and their dissemination, but one element emerges as the most significant – transparency.

Transparency is the real lifeblood of the market as a genuine information flow helps transactions and monitoring of behaviour that militates against a free market.

Each of the cases examined has a set of features that could be cited as best practice in the Italian system, such as the following:

- Data is managed independently by research bodies but provided by a central institution;

- The process of data acquisition and “who does what” is clearly reported;

- The language in the documents disseminated is clear, the statistics are easy to understand and the evaluations are neutral;

- The indicators are updated in real time (in the case of Switzerland and New Zealand), providing an updated picture of the market;

- Behind an evaluation on a statistical basis there must always be a reliable and central source;

- Transparency enables anyone to give opinions (as in the press or in agency ratings for countries) but the opportunity to refute those evaluations is a guarantee of good practice;

- Research must be based on reliable data and the time horizon must not be too long otherwise the longer timeframe will invalidate the scientific basis of the result;

- Research considered essential must not serve only one specific purpose - it must report available data, aggregating it and preferably commenting on it in a box where the distinction between the data and the respective interpretations is clear.

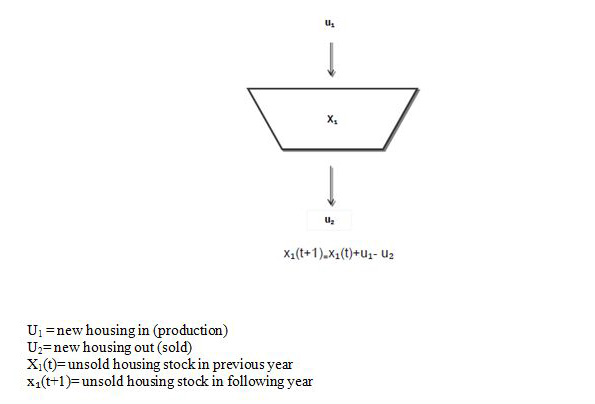

2.2 The balance model as a tool to define how unsold stock originates

The case studies above underline the need for a system that can help define the amount of unsold stock.

From a methodological point of view the balance model is followed, linking the amount of new unsold housing stock, available stock and the amount of housing sold, and updating the data on a regular basis.

This model can provide the tools to study the impact of the economic crisis in the real estate market analytically. Moreover, by analysing separately building production and the rate of absorption it is possible to make specific evaluations of the potential consequences of external factors.

For example, in the current critical situation of the market we can see which external factors influence the model, i.e. those which show variations in u1 (production) and u2 (sold stock).

The following variables influence u1 (fall in production due to the crisis):

- Squeeze on corporate credit by lenders;

- Fall in demand and resultant decrease in production;

- Insolvency of some weaker companies;

- Depression effect following the introduction of the property tax (IMU);

- The new property tax (IMU) does not provide municipalities with the percentage of income stream that the old Italian Council Tax (ICI) did, while real estate is targeted by tax.

The following variables influence u2 (fall in demand, “selective” buying decisions):

- Squeeze on family credit;

- Unfavourable macroeconomic climate and fall in GDP;

- Low expectations of households as regards regular repayment of mortgages;

- Low expectations of households to maintain current steady employment situation;

- High price of property compared to purchasing power;

- Quality now more important to buyers, who use it for greater contractual leverage;

- Collapse in constant revaluation of property;

- Unsold property seen as depressing demand;

- Property tax levied on rental accommodation and owner-occupied property.

Basically, when identifying and determining the consistency of the various phases (production, stock, absorption), it would be easier to identify those variables that modify the relationship between supply and demand, and which therefore generate unsold stock.

Clearly, to apply this model all the necessary data must be available: the number of homes produced every year, the number of homes sold, available stock, accumulated stock and, above all, indicators need to be designed to represent numerically the influences of external factors on production (u1) or the rate of absorption (u2).

3. Concluding Remarks

The most significant critical issue is how to build a reliable database in Italy. Data is reported randomly and updated infrequently, leading to the risk of making assumptions and estimates based on data not adequately representative.

Moreover, critical factors are not only linked to the lack of integrated data and to obsolete information, but also and above all to the lack of streamlining of the processes and models used to manage information by the operators and public bodies involved .

One sensible solution would be to adapt the methodology called BPR Business Process Re-engineering (Hammer M., Champy J., 1993), used for reviewing the planning of processes in an industrial environment, with a view to analysing the processes of all stakeholders involved, the tools and the information used. It is, of course, necessary to bear in mind that manufacturing industry has different features to the real estate market. However, it is clear that one of the most important problems is the lack of interface between processes within the real estate sector. This article has attempted to show how at least part of the real estate market uses the lack of transparency in processes and the random reporting of information as a very strong competitive driver.

The balance model proposed can act as an incentive to find a way of identifying the exact volume of unsold stock in Italy and provide an analytical approach to studying how it has been accumulated and continues to accumulate.

This must be the starting point for studying the repercussions, causes and consequences of production over-supply.

It is not easy to bring together those parties who hold the information, but this is the only solution. To do this we need a change in the processes that are currently in use to report and management all the information.

The random nature of information is one of the pillars on which the uncertainty of the real estate market is founded, and which delivers immediate advantages for a few producers and more often than not disadvantages for consumers. Greater transparency and availability of data with clear cut rules can undoubtedly contribute to providing new incentives to the market (Garmaise M.J., Moskowitz T.J., 2004).

References

Ance-Cresme (2011), “Il mercato immobiliare in Lombardia nel 2011” [Real Estate market in Lombardia in the year 2011] , final report, pp.276.

Bank of Italy (2009), “L’andamento del mercato immobiliare italiano e i riflessi sul sistema finanziario” [The Performance of the Italian Housing Market and its Effects on the Financial System], in Quaderni di economia e finanza, n.59, Banca d’Italia, Rome, December 2009

Camagni, R. (2012),”Verso una riforma della governance territoriale” [The way towards a reform for territorial governance], Quaderni del Territorio n.2, Università di Bologna, available at URL http://storicamente.org/quadterr2/camagni.pdf (accessed June 5th 2013).

Camera dei Deputati VIII Commissione permanente (2010) (Ambiente, territorio e lavori pubblici), “Indagine conoscitiva” Documento conclusivo approvato dalla Commissione, Roma 2010

Catalunya Caixa (2011), “Informe sobre el sector inmobiliario residencial en España, Análisis territorial para Cataluña, el área de influencia de Madrid, la Comunidad Valenciana y Andalucía” [Information about Real Estate Residential sector in Spain. Territorial analysis for Cataluña, Madrid area, Comunidad Valenciana and Andalucía], Barcelona, June 2011, pp. 3-97, available at URL http://www.catalunyacaixa.com/docsdlv/Portal/Ficheros/Pdf/es/inmobiliario_mayo11.pdf (accessed June 5th 2013)

DIAP-Politecnico di Milano (2012), “Quante case per quali domande” [Housing supply and need in Lombardy 2012] paper presented at conference: Quante case per quali domande, indagine svolta per CISL Lombardia, Milano, March 27th 2012

DIAP-Politecnico di Milano (2012), Offerta e fabbisogno di abitazioni al 2018 in Lombardia indagine svolta per CISL Milano, March 2012

DIAP-Politecnico di Milano (2011), “Quante case per quali domande” [Housing supply and need in Lombardy 2011] paper presented at conference: Quante case per quali domande indagine svolta per CISL Lombardia, Milano, Jan 17th 2011

EUPOLIS Lombardia (2011) “Il patrimonio immobiliare invenduto in Lombardia” [Unsold stock of housing in Lombardia], Milano, 23rd September 2011, pp.5

Frontera, M. (2012) “Scenari Immobiliari, Edilizia e Territorio: Monitoraggio del mercato immobiliare” [Real Estate scenarios, building environment and territorial: Real Estate market monitoring], Edilizia e Territorio, May 25, pp.1, Available at URL http://www.casa24.ilsole24ore.com/art/mercato-immobiliare/2012-05-23/sono-130mila-abitazioni-invendute-104912.php (accessed June 5th 2013)

Garmaise, M. J., & Moskowitz, T. J. (2004), “Confronting information asymmetries: Evidence from real estate markets”. Review of Financial Studies, 17, 405–437.

Hammer M., Champy J. (1993), “Reengineering Corporation: A Manifesto for Business Revolution”, Harper Business Books, New York, NY

Gebhard, F. (2007) “The National Register of Buildings and Dwellings in Switzerland and its and its Role in Future Population and Housing CensusesHousing Censuses” paper presented at the Seminar on Registers in Statistics - methodology and quality21 - 23 May, 2007 Helsinki, Available at URL http://www.bfs.admin.ch/bfs/portal/en/index/themen/00/05/blank/01/06.Document.97629.pdf (accessed June 5th, 2013)

Pileri, P. (2011), “Evoluzione del consumo di suolo e dei bisogni insediativi” [Evolution of land use and settlement needs], paper presented at Meeting interdisciplinare Terra, Milano April 22nd

Please read and download this article as PDF as well: Italian_housing_market.pdf